How to Store Bitcoin

Holding bitcoin is similar to storing large amounts of cash in that it necessitates taking some precautions to protect and secure one’s wealth. While some traders – who spend their days trading between Bitcoin and other cryptocurrencies – may choose to leave their bitcoins on an exchange, the most secure way to hold bitcoin over the long term is to use a bitcoin wallet store the cryptocurrency.

Bitcoin wallets are available in various formats, each with its own set of features that distinguishes it from the others. Because everyone’s needs are different, it’s essential to consider both one’s trading or investment habits and one’s security requirements before making a long-term commitment to a specific type of wallet.

Desktop Wallets

Desktop wallets are popular because they allow users to access their bitcoin address from the same computer that they trade from. However, desktop wallets are typically not as portable or usable in the wild as mobile wallets.

Thousands of computers worldwide are running the popular Bitcoin client, known as Bitcoin Core, to process bitcoin transactions. Nodes on the network are formed by users who perform the critical task of relaying transactions; however, this software also allows users to create a Bitcoin address. It also allows them to send and receive bitcoins and store their private key on their computer.

Not all desktop wallets, on the other hand, are required to function as nodes. Some choose to serve as a software wallet that can store both keys and is developed by third parties, whereas others choose to do more. The download and maintenance of these are typically much less time-consuming, and they may be available with specific features or focuses that investors may find appealing.

Mobile Wallets

Like their desktop counterparts, Mobile wallets are software programs (apps) that can be downloaded and installed on a user’s smartphone. This is usually only available on Apple’s iOS (iPhones), Android phones, and some are even available on Microsoft’s lesser-used Windows Phone platform.

Mobile wallets offer investors and traders the benefit of taking their wallets with them wherever they go, in contrast to desktop wallets, which are only marginally mobile and not pocketable. This further enables users of specific mobile wallets to make quick and easy payments with bitcoin and other cryptocurrencies, which is a significant convenience.

Cold Storage

While we can consider both desktop computers and mobile phones as “hardware,” there are several electronic products available that are specifically designed to store one’s public and private key pairs, such as the KeySafe. These are commonly referred to as “hardware wallets or cold storage,” and you can use them to store information and facilitate payments.

Hardware wallets are often compared to USB drives, though the similarities and differences between brands can be significant.

Hardware wallets are typically comprised of two parts: an online component and an offline feature. When an investor uses this method, they make use of an online wallet that contains their public address and signals which transactions will be “signed.” To complete a transaction, users will have to connect their hardware wallet via USB to a computer, where a signature will be generated and sent to the wallet, after which the transaction will be entered into the Bitcoin Blockchain.

Specific to hardware wallets, some devices provide users with the security of storing a user’s private key in a so-called “protected area” on the device in question—which means that the private key cannot be divorced from or used outside of the device in question.

Note: Traders hardly need to store bitcoin as most trade BTC and other cryptocurrencies for fiat. Especially those that trade with crypto trading software such as the BitQL software. There are some also that use cryptocurrency exchanges where they can trade crypto for fiat.

Hardware Wallets

Hardware wallets, unlike software wallets, keep your private keys on an external device such as a USB drive. They are completely cold and safe. They’re also capable of making online payments. Some hardware wallets accept different currencies and are compatible with web interfaces. They’re made to make transactions simple, so all you have to do is plug it into any online device, unlock your wallet, send money, and confirm the transaction. Hardware wallets are said to be the safest way to store cryptocurrency. The only disadvantage is that they are not available for free.

The most secure method is to purchase a hardware wallet straight from a manufacturer. Purchasing it from others, especially those you don’t know, is risky. Even if you buy a hardware wallet from a manufacturer, you must always initialize and reset it.

Typically, the wallet you choose is determined by your investment portfolio. Every significant project should have its own native wallet, which should be available on its website. However, a multicurrency wallet may be more convenient in some cases. It’s important to note that not all multicurrency wallets support all coins. Even hardware wallets can only support a certain number of coins. On the other hand, significant cryptocurrencies have no scarcity of wallets.

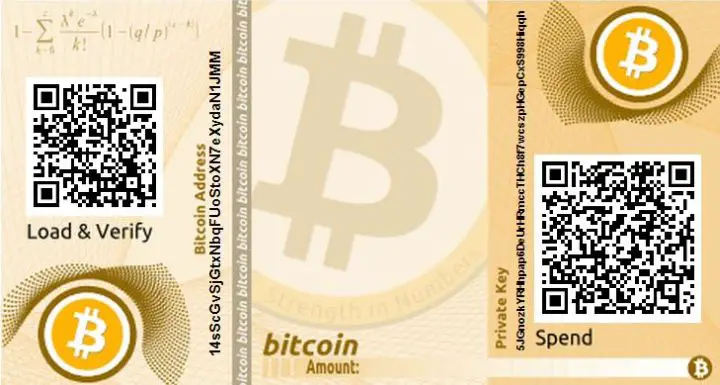

Paper Wallets

A paper wallet is a sheet of paper that contains the private and public keys for a single bitcoin address. Paper wallets, which have been around since the beginning of Bitcoin, are a cheap and secure way to keep bitcoin holdings. Many people believe they are the safest way to store bitcoins because private keys are kept cold or offline, away from hackers. Paper wallets can be a secure way to store coins for lengthy periods if they are physically protected.

Keeping Bitcoins in the Form of Physical Coins

There are a few services that enable you to purchase physical Bitcoins. You buy this real coin, which has a tamper-proof sticker on it and a predetermined quantity of Bitcoins underneath it. Physical coins are a famous collector’s item, and they can be kept in the same way that jewelry or gold is kept — in a bank or a safe. One disadvantage of buying actual coins is that you will have to pay a premium for Bitcoins; for example, a coin containing $100 in Bitcoin could cost $150 or more. Furthermore, you must have faith in the coin’s issuer to properly secure the private keys and not steal the bitcoins at a later date.

Using a Multisignature Wallet to Store Bitcoins

A Multisig wallet is a less specific option to store your Bitcoins. Before a transaction can be completed in a Multisignature wallet, it must be approved by multiple people. This would be an excellent way to store Bitcoins that belong to numerous people, such as those held by a firm with a Bitcoin fund. If you don’t want a single person to have access to your company’s funds, you can set up a signature wallet that requires multiple executives to sign off on a transaction before it is approved.

Conclusion

Each type of Bitcoin wallet has its own set of advantages and disadvantages. It is up to each user to ensure that their accounts are adequately protected while also selecting the most convenient and affordable option for them.

Even though online or software (desktop or mobile) wallets provide convenience and quick access to the internet, they do so at the expense of security, making them a prime target for internet hackers looking to steal bitcoin or other cryptocurrencies from users over the internet.

However, physical storage devices can be easily stolen, damaged, or degrade over time due to their inherent vulnerabilities. A good rule of thumb is to consider using various wallets and making sure that one’s bitcoin allocation does not rely solely on a single wallet.