What is the Current State of UK Mortgages?

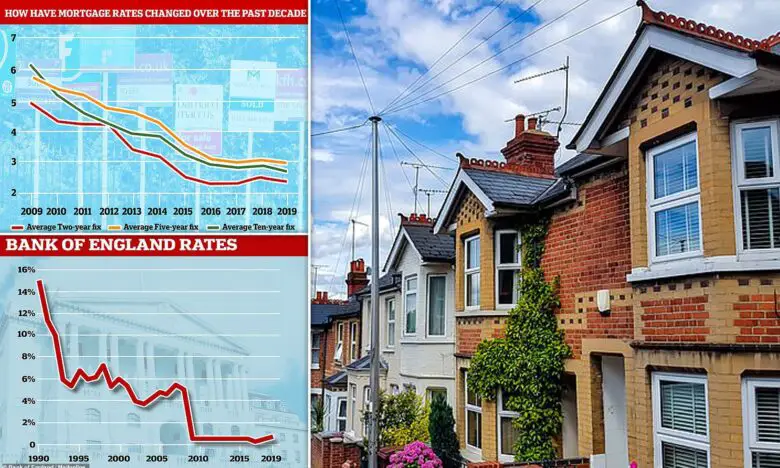

With the decision of the Bank of England to cut interest rates to 0.1 percent, many will be looking at whether this will influence their existing mortgage or plans for a future mortgage.

With the drop to 0.1 percent being the second cut in eight days, the current level is a historic low in an emergency response to the damaging impact the virus is having and is set to continue having on the economy. This cut too many will be dramatic considering the market crash of 2008 only saw it drop to 0.25 percent. For more information click here.

Ultimately, as the level of pandemic rises, and measures continue to be implemented that contain the virus, the shock on the economy will be substantial but, importantly, temporary. The Bank of England is making every effort to meet the needs of UK businesses and households to deal with the inevitable economic disturbance.

Here at FJP Investment, we decided to have a look at how people can take advantage of and avoid adverse interest rate fluctuations with regards to mortgages.

Will my mortgage go down?

Mortgage rates have already been at near-record lows for over a decade. What this means is that people on tracker mortgages will notice an immediate slight decrease in mortgage repayments, but this will not be significant. Those on fixed-rate mortgages, this being most people due to levels being low in recent years, will not benefit from this drop.

Should the interest rate stay at this level for an extended period, this will gradually filter through to fixed-rate products. With the level of interest being so low, many will be viewing now as a fantastic time to secure a mortgage or to re-mortgage an existing property.

Activity in the mortgage was already at a four year high before the initial cut to 0.25 percent implemented soon before the second cut, so banks expect very high levels of activity in those looking to re-mortgage their property. For those looking to buy property, although activity in the market is naturally slowing down, now is a great time with interest rates being so low.

The impact on first-time buyers

The impact on first-time buyers could be detrimental though. With interest rates cuts reducing payments on a new mortgage, so too will it reduce income in a savings account. Those looking to build a savings pot should be looking into low-risk investments to grow their money.

With the level of interest rate sitting so low, those holding money in a savings account are losing money in real terms when compared to the rate of inflation. Those saving for a house should be aware of this and research the various investment platforms out there to aid them in raising the money for a mortgage.

In addition, first-time buyers should be taking advantage of the 5 percent mortgages being offered, now really is a great time to purchase the property. The difficulties come in viewing the property.

Can I view property in a lockdown?

Thanks to the rise in technology, many estate agents are beginning to offer ‘virtual’ property tours for those looking to sell the property. In fact, we have seen over a 50 percent rise in these viewings, suggesting this form of property viewing may be here to stay even after the pandemic passes, particularly useful for overseas investors.

Of course, many will be hesitant to purchase property on the back of a virtual viewing alone. This does give sellers and buyers a good opportunity to raise interest in the property though. With a second viewing taking place in the future when the pandemic eases, the likelihood of a sale is set to increase with the buyer already expressing a reasonable interest in the property.

Will we receive a ‘mortgage holiday’?

Ultimately the moves the Government has introduced are there to ease the shock hitting the property market. Promises have been made to back up lenders by offering mortgage repayment holidays to homeowners that have seen their income fall as a result of the virus. This extends to buy-to-let landlords whose tenants are unable to pay rent for the same reasons.

Homeowners will need to apply to their bank. There will be a fast track approval for this, but not everyone will be granted a payment holiday. Only those that have lost income as a result of the virus.

The interest will be recovered later, so for those able to pay the mortgage, it is probably best to do so. It is important to note that those eligible will have no negative effects on their individual credit rating. In short, the mortgage holiday by no means is free money but will provide relief for those that need it.

With the Prime Minister also announcing emergency legislation to ensure private landlords and social tenants cannot be evicted if they cannot pay their rent for up to three months, the action is beginning to take place to ensure that those who are the most affected are being helped financially.