Need a Medicare Supplement Plan? Use These 7 Tips to Pick the Plan Best for You

When you’re searching for a Medicare supplement insurance plan, several things to consider. Plan costs, coverage, and prescription drug coverage are among the main things to consider. Other types of coverage, such as what kind of doctor you see and prescription options, should also be considered.

Medicare Costs

The Medicare premiums you pay for a supplement plan are fixed for a year. Your insurance company will likely raise your rates to keep up with inflation as the costs increase.

All the supplement plans are standardized, but the prices can vary significantly from one insurance company to the next for any given plan. That’s why it’s a good idea to shop around every year before you lock in your coverage.

Other than being aware that costs can rise each year, there are no special tips to help you pay less for Medicare supplement coverage in 2024. You just need to compare plans and get quotes from multiple insurance companies.

Coverage

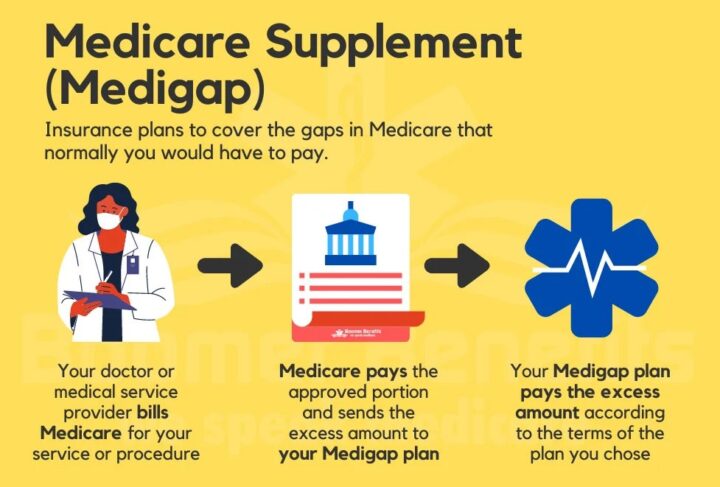

Medicare Supplement plans, often known as Medigap plans, offer additional coverage for you in 2024. This benefit is that you have less out-of-pocket costs for your healthcare needs and more coverage. As nice as this sounds, there are a few things you need to keep in mind before purchasing a Medicare Supplement plan.

First, all the benefits are the same no matter which insurer sells them. If you purchase Medicare Supplement plan F from one insurance company, it will be the same as Medicare Supplement plan F from another insurance company. The only difference is the price. This is why it’s essential to shop around and compare prices to get the best deal possible. While looking for a Medicare Supplement plan, make sure that the company selling it has a good reputation and history of customer satisfaction. For more information check agilerates.com.

Next, you can only purchase a Medicare Supplement plan if you have Original Medicare Part A & B. If you do not have Part A and Part B, you cannot purchase one of these plans since they are supplemental insurance to your Original Medicare benefits. If you want to get one of these plans, you must apply through an insurance company or agent for your other Medicare benefits at age 65.

Your Other Coverage

If you have other insurance coverage, talk to the carrier about how Medicare works with that coverage. If you have retiree health benefits from a former employer, ask your HR department if the plan will pay for some costs not covered by Medicare.

Also, if you are enrolled in a Health Savings Account (HSA), check with your employer or the benefits administrator to make sure Medicare won’t affect your HSA eligibility. You can keep contributing to your HSA if you don’t sign up for Medicare. But if you do enroll in Medicare, you may no longer be able to contribute.

Prescription Drugs

What do you need to do about prescription drugs? If you have a Medicare Supplement Plan, you can use your Medigap policy for drugs. You’ll be able to use your card at any pharmacy that accepts Medicare Part B. If you need a lot of prescriptions, consider getting a Medicare Advantage Prescription Drug Plan (MAPD) instead of a Medicare Supplement Plan. These plans provide coverage for both medical expenses and prescription drugs.

Doctor and Hospital Choice

When it comes to Medicare Supplement Plans, one of the most important things you can do is choose doctors and hospitals that belong to your plan’s network. This is also referred to as “provider selection.” Medicare Supplement Plans with more extensive networks generally cost more than those with smaller networks. But don’t let that fool you into thinking that a limited-network plan is always the cheaper option—the key here is to find the network that works best for you. If your current health professionals are in-network with a particular plan, choosing another plan may result in out-of-pocket expenses.

But be sure to shop around for plans offered by different insurance companies. Even if your current provider accepts one insurance company’s Medicare Supplement Plan, there’s no guarantee that they will accept every other plan. Do your research and make sure both your doctor and your hospital are in the network of any plan you’re considering.

Another thing you should know before planning is whether or not a plan covers out-of-network providers at all, which some do and some don’t.

Quality of Care

Quality of care is essential when it comes to Medicare Supplement Plans. You want to ensure that your plan will give you access to doctors and hospitals in your area. The best way to find this out is by checking with the insurance company directly. Some insurance companies only work with certain doctors and hospitals, so you need to be sure that your plan will cover you.

Travel

Travel Medigap plans offer comprehensive coverage for an extended period — usually six months or 12 months — so that you don’t run into any surprises when traveling abroad or even domestically if you’re away from home for an extended period.

Consider What You Get for Your Money

When picking your Medicare Supplement plan, you must carefully consider what you get for your money. If you get an expensive plan and then don’t use many benefits, you may waste money on a plan that isn’t right for you. On the other hand, if you go with a cheaper plan, it may not protect you fully in case of an emergency or significant injury. Research all the options, weigh your budget appropriately and then talk to your doctor about which insurance company and plan might be the best fit for you.

The Bottom Line on Medicare Plans

Shopping for the perfect Medicare plan does not need to be difficult. Figure what you need most out your Medicare supplement plan and then check out MedicareConsumer.com. Here, you can receive multiple offers from top rated carriers and then once you speak with their licensed agents, you can then better determine which plan is best for you fast.