How to Make Your Home Disaster-Resilient

Homeowners should seriously think about the effects of natural disasters. Floods, blizzards, and wildfires have the potential to destroy years’ worth of hard work. As an investment, you need to protect your home from every scenario that’s out of your control.

It all boils down to how you invest time and money in upgrades that can minimize or prevent damage to your home. This guide will help you make your home disaster-resilient so you will have peace of mind regardless of what happens.

1. Survey your location

Before purchasing materials or deciding what upgrades to make, you need to know the level of risk your home is facing. There is no such thing as a safe community. Every location has its hazards. Los Angeles, for instance, doesn’t have to deal with blizzards, although it experiences up to 10,000 earthquakes each year.

It’s important to do research on your location and identify what possible disasters you will need to prepare for. You can start by checking for flood maps and active fault lines near your location. In addition, you can also check if the community has experienced severe storms. Knowing these risks can help you come up with a checklist for improving your home.

2. Get guidance from FEMA

The Federal Emergency Management Agency or FEMA is the government’s main institution for handling disaster preparedness. It is tasked with drawing up guidelines for helping homeowners mitigate the impact of natural disasters as well as man-made events.

FEMA provides instructions for every scenario, so you need to follow the agency’s recommendations across all stages of homeownership. Whether you are buying a home or building one from the ground up, FEMA has everything you need to prepare for any scenario.

Learning about FEMA’s services and guidance for events such as earthquakes and heatwaves can help you maximize the time and resources you have in reducing immediate damages and making it easier to recover.

3. Get insurance coverage

During the process of applying for a mortgage, your lender will require you to purchase a homeowner’s insurance policy. Getting the right policy can help you recoup your losses in the event of unpreventable damage, especially if your home is located in a high-risk area.

However, your policy may not cover certain types of disasters. Standard home insurance only covers damages caused by wildfires and wind. You may need to purchase a separate policy if you want to protect your home from floods, landslides, and earthquakes.

For instance, in the case of floods, you will need to get flood insurance under the National Flood Insurance Program. Private insurers also provide this policy which is designed to help you recover faster after a flood.

If you live near or around an active faultline in California, you are required to carry an earthquake insurance policy from the California Earthquake Authority. This covers your dwelling, although you need to purchase additional coverage if you have fragile valuables.

Take your time shopping around for an insurance policy that aligns with the dangers you face as a homeowner as well as your budget. While it won’t prevent damages, getting coverage can help you move on from any disaster even if you’re living as far as Alberta, Canada.

4. Secure the structure

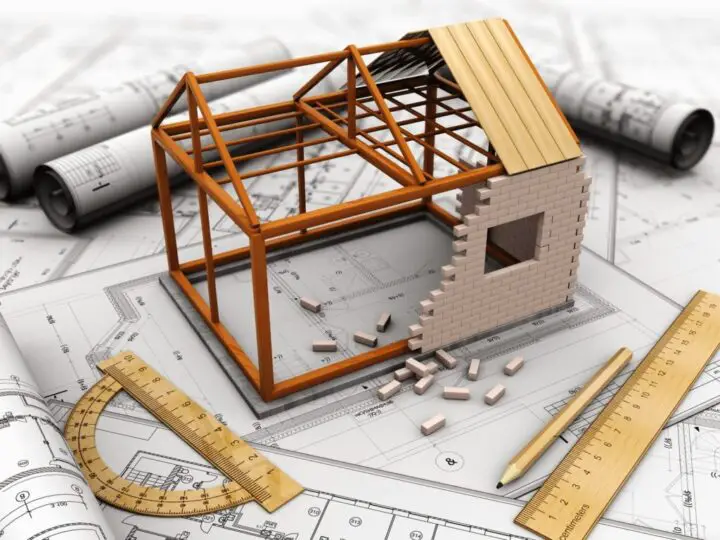

Living in a disaster-prone neighborhood is all the reason you need to improve the structural integrity of your home. In case you are building it from scratch, you may have to determine the materials and construction technology you need to enhance your home’s ability to withstand certain hazards.

If you live in earthquake-prone areas, you might want to construct your home using shear walls and memory alloy. The foundations should also have shock absorbers which can help reduce vibrations and minimize damage. If you’re located in a region where winters can reach sub-zero levels, your custom home design should allow for optimal insulation.

On the other hand, you may have to invest in additional improvements if you bought a home that needs to be reinforced. In this case, the first thing you will need to strengthen is your roofing system. Tornadoes and hailstorms can cause significant damage, so if you are looking for a guide for beefing up your roof, click here. In addition, you also need to reinforce your windows using pressure-sensitive adhesive.

It’s also best practice to support your cripple walls if you bought a home within or around an earthquake zone. For this, you only need to install plywood sheathing on these walls with the help of a contractor. You can also do it yourself so long as you follow the right procedure in retrofitting your home. In this case, you will need to determine the proper thickness and type of material you are using.

In addition, consider adding anti-slip mats to furniture such as tables and chairs. You can also invest in tension poles which can help keep larger appliances from being damaged during a strong earthquake.

5. Landscaping

In any disaster scenario, your surroundings can help protect your home from damage or become the cause of damage. During a heavy flood, for instance, soil with high porosity can suck water into the ground and reduce the flood water that enters your home. You can try digging ditches that can help divert most of the water to the ground.

If you live in a city located in a hurricane-prone region, surrounding trees can cause significant damage. High winds can snap off branches which can turn into projectiles. For this reason, consider pruning the trees around your home as hurricane season arrives.

Focus on trees with thick canopies as well as dead vegetation. If you have trees outside your premises that could pose a danger to your home, reach out to local authorities and check if you need a permit to cut or prune these trees.

While it’s impossible to control any eventuality that comes along, there are numerous ways you can protect your home and your family from serious situations. Consider these tips and attain peace of mind.