What Was The First Country In The World To Use Cryptocurrency As Its Legal Tender?

You would have been hearing a lot of new terms in the industry, which would have left you flabbergasted. However, this particular term, cryptocurrency, has been gaining immense popularity because even though it’s a highly trending topic, very few people know the in-depth insights of the concept.

This makes it a highly misunderstood concept, so let us understand some basics about cryptocurrency, how it occurs, and the major hurdles countries face in choosing it as a legal tender for transactions. El Salvador is the first country which took the initiative to make cryptocurrency a legal tender and accepted it for making transitions.

How Do Cryptocurrencies Work?

Cryptocurrencies take the world to a halt because earlier, this concept was thought to be used for efficient data exchange methods. Still, soon it came to be utilized as a cryptocurrency method which transformed the world. So currently, everyone is fixated on cryptocurrency and blockchain, so let us briefly understand how the process works. The first thing in the entire process is the requirement of an exchange application allowing you to buy cryptocurrency in exchange for your money.

You can check the reputed websites such as Moonpay if you are willing to buy bitcoin.

Once you have bought the cryptocurrency, you can make exchanges in cryptocurrency as per the token standards. Now you would be wondering if it’s something like a stock exchange, but it isn’t because, in this exchange, there is a change of hashcodes of the virtual currency, which establishes the ownership over the digital asset. This was a brief understanding of cryptocurrencies and how their exchange takes place, but now let us understand the hurdles they face that make it tough for them to become legal tender in multiple countries.

Why Are Cryptocurrencies Not Considered A Legal Tender?

Each currency is considered legal tender when it’s accepted by the main financing institution of the country for transactions and other monetary purposes. Multiple reasons contribute to the unavailability of cryptocurrencies as legal tender, and some are listed and discussed below in detail.

Volatile

The value of crypto tokens does not depend on the asset’s value, but the demand and supply of the particular token highly influence it. When there is a rise in demand for a particular crypto token in the industry, there is a spike in its value, which benefits the previous owners to enjoy the benefits and exchange their cryptocurrency for other crypto tokens or bank transfers.

This does not provide a legal explanation of the price change, which provides very limited countries to rely on it as a legal tender. Because if a crypto token is made a legal tender and people are completing their transactions with it and then suddenly someday the price falls to almost null, it would directly affect the value associated with the tokens. So the volatility of these crypto tokens makes them a risky asset for countries to turn to as legal tender.

Exchange

The business exchange of cryptocurrencies involves considerable costs and fees, and each platform charges different fees for the same transaction. So if the crypto tokens are legalized, then the first thing that has to be kept in mind is that the government needs to create a reliable platform where people can make crypto exchanges with the universal fee which the platform would charge to all the customers based on multiple variables involved in the transaction. At such times there is https://bitcoin-buyer.io/, a reliable platform which can make things much easier for you and allow you to enjoy the best functionality. This platform is the innovation for tomorrow which would make bitcoin transactions better and easier.

Taxes

The sudden rise of cryptocurrency trade resulted in immense profits for people. This was when the government imposed taxes on the profits earned by crypto trading because they were not legal tender but digital assets. There are no certain taxation rules for crypto trading in multiple countries, which puts the choice of legal tender at risk.

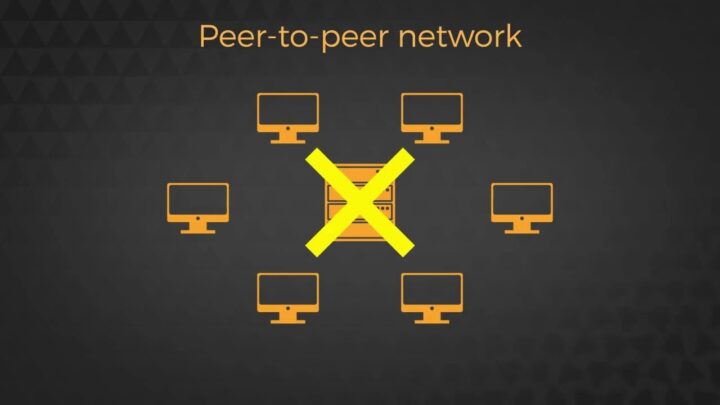

Peer-to-Peer Network

Cryptocurrency works on a decentralized mode of working which does not involve a central body which is both a boon and a curse. When there is no central body to regulate and manage expenses, it becomes tough for the government to rely on a peer-to-peer network. Though a well-maintained DNS is regulated in this peer-to-peer network but still without the government in control, it’s hard to rely on a network.

Uninsured

A crypto transaction is just a sure call of your knowledge and luck because you cannot insure these transactions; either you are winning profits or making losses. There are no midways in crypto transactions, as you can seek insurance on your stock deals, but you cannot seek insurance on your crypto transactions.

Malicious Uses

It has been found that since the year 2020, there has been a rise in cyber attacks and ransomware attacks which has made it tough for people to keep their businesses safe, and each time the mode of ransom was the same, the people asked for a ransom in the mode of cryptocurrency. The major reason is that after some tweaks and high technical knowledge, you might be able to make your crypto transaction untraceable.

Technical Resources Unavailability

Multiple countries do not have reliable resources that would be able to process massive chunks of data to ensure that all crypto transactions are done smoothly. So they would require secure servers and a response team that would be all prepared in case of an emergency; furthermore, highly configured systems would be needed to monitor the foreign trades, which would be tough to manage. Suddenly forming a completely new department of digital assets would be a hard call for many countries.

Conclusion

Though it’s a bit of a hard thing, it’s not impossible for a government to declare these crypto tokens as legal tenders. With the right solutions to these issues, it would become easier to use them for banking and other necessary transactions. Though some counties have imposed taxes on crypto profits, there are still no direct rules of taxation and management of such transactions.