Why Are Crypto Transactions Irreversible – 2024 Guide

Cryptocurrency has become a new craze. All the investors are getting drawn towards it with every passing day. Be it a small city or metro, it has recorded top growth in every geographical area. With cryptocurrency on the boom, traders are spending hours sticking their eyes on the screen, tracking bitcoin prices all day.

Bitcoin is a versatile form of money that has become an online phenomenon. The value of the cryptocurrency has soared way up from the year 2013. Bitcoins gained fame because they aligned with real money. You can buy, sell or move it from anyplace anywhere with as simple as a click on the screen.

Various trading platforms provide bitcoin currency trading. One of which is ImmediateConnect.The platform serves to buy and sell services with quality strategies and research outcomes for its customers to increase their profits.

The Irreversible Nature of Cryptocurrency

Cryptocurrency may be an economic phenomenon, but there are definite weaknesses also. One of the most pressing is the nature of translation entered by an investor. On several occasions, cryptocurrency users, especially bitcoin users, face the inability to reverse the activity.

This inherent weakness has become a threat, and traders are an accepting advantage of it. Now the bitcoins have been reversed after they fulfill a condition. The transaction will have reversal when the user has complied with various verification procedures outlining the following rules and procedures.

The undo button has a luck factor. The user has to try and reverse the transitions only if the blockchain has nil confirmations. If they receive affirmations from the blockchain, it will be impossible to reverse such activity.

Simply put, the bitcoins sent to a particular address cannot reverse back unless the receiver sends them. It happens regularly with the traders. It has caused phishing scams to erupt even more.

Methods for cryptocurrency transaction Reversal

A cryptocurrency transaction will reverse only when the transaction is not confirmed. People can receive the virtual cash sent on from the wallet when the blockchain has not yet accepted the transfer.

The process of reversal is very complicated. There are two strategies for canceling unconfirmed transactions.

Most of the time, traders lose their money as a lesson of the world of cryptocurrency.

Why are Cryptocurrency transactions irreversible?

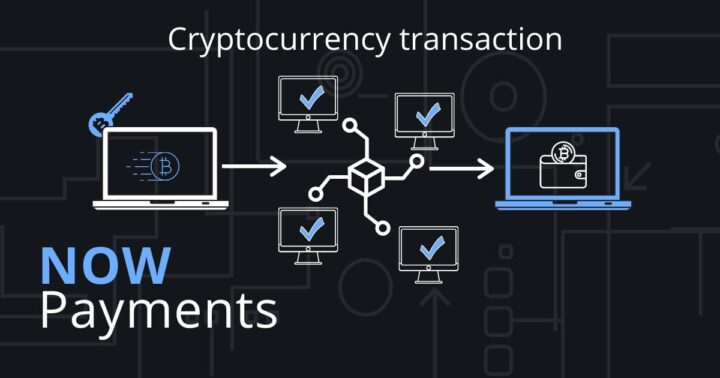

The cryptocurrency world has reasons the transactions one enters cannot go back. As the currency’s ownership transfers from one address to another, the blockchain quickly updates the transfer. They record the ledger with the transfer request.

But what are blockchain confirmations? How does it take place? Let us have a look.

Blockchain Confirmations

Blockchain transactions confirmations are a way of verifying a transaction. The blockchain rejects an activity when there is any stain of a fraudulent mechanism.

A transaction has to receive more than three confirmations on average for the action to be accepted. The confirmations depend on the size of the transaction. The larger the size, the more blockchain confirmations are required.

The confirmation can be as quick as 10 minutes and might take days to confirm. But the affirmation is not enough for a transaction to be accepted. The user has to wait for it.

The other reason for the features is the absence of any intermediary in cryptocurrency transactions. When a seller passes the currency to the buyer, he loses the right to claim it back or retrieve it. Once the ownership changes, there is no way of complaining or requesting.

No third party Regulator in Cryptocurrency

Unlike the traditional financial system, cryptocurrency lacks financial intermediaries. Although global authorities are working on measures to avoid malpractices and criminal activities, the entire cryptocurrency has no regulator to regulate the transactions.

It is an impressive financial industry that has grown much from the traditional market, but the lack of a regulatory framework is a susceptibility.

There are no third-party intermediaries to guide traders with their mistaken transfers. The traders can do nothing but pay heed to their guilt.

As cryptocurrencies work in a decentralized platform, there is no central authority to manage or issue such currencies. The currency depends on a process that has no third-party arbitration.

Consumer Protection

Although there are no protections while trading using blockchain technologies, in case fraudulent activities take place, several companies have stopped to fill the gap and simplify the blockchain transactions.

The primary aim behind introducing blockchain was the elimination of middlemen. So the very purpose of the invention of blockchain seems to be defeated with such interventions. They formed cryptocurrency platforms to create a trusted environment for the traders.

While any government or regulation does not back the cryptocurrency, many consumer protection regimes are opening up in various countries. Until the formulations are on their way, consumers may have to accept the caveat emptor principle in their minds.

What is the solution for incorrect cryptocurrency transactions?

First of all, we cannot undo a cryptocurrency transaction unless the transaction is unconfirmed. The confirmation status plays a significant role in getting the money back. Some of the transfers take days for the blockchain to confirm.

Here are the two ways you can cancel an unconfirmed transaction:

- RBF Protocol

- Higher fee double-spend transaction

Various cryptocurrency wallets support replace by fee (RBF) protocol. It assists you in rebroadcasting the currency in return for high fees. They often use it when a trader is stuck with his currency transaction and wants to unstuck it.

So, the protocol helps you broadcast the transaction to the blockchain. The trader has to enter into a new transaction having a high pay fee. The miners replace the latest activity with the old one. They record the new transaction after dissolving the old one.

Conclusion

Cryptocurrencies have shaken the financial market with their innovation and features, but the newly discovered vulnerabilities have trotted the success down. The limitations while using the currency are disturbing for the traders. Cybercriminals exploit this feature of irreversibility to their advantage. There is a need for crypto users to be vigilant with the trading process.