5 Things To Know About Crypto Escrow Transactions

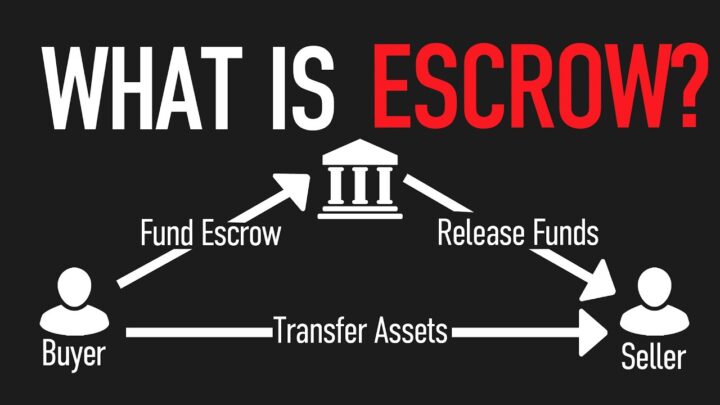

In the world of cryptocurrency trading, an escrow transaction is a type of trade where the buyer and seller agree to use the third party to hold, or escrow, the digital currency during the trade. The escrow agent agrees to release the currency to the buyer once the buyer has paid the agreed-upon price for the currency, and they also agree to release the currency to the seller if the buyer does not pay.

Escrow transactions are often used in trades involving large amounts of money, or when one party does not trust the other party. They are also commonly used on online exchanges and trading platforms as a way to protect both parties in a trade.

Here are five things you should know about crypto escrow transactions.

1. It’s Super Simple

If there’s one thing to know about crypto escrow transactions, it’s that they’re actually quite simple. All you need is a third party to hold the currency during the trade, and both parties agree to the terms of the trade. Once the trade is complete, the escrow agent will release the currency to the appropriate party.

If that’s confusing by any chance, here’s a step-by-step breakdown of the process:

- Both parties in a trade must agree to use an escrow agent.

- Once an escrow agent is agreed upon, that agent will hold onto the cryptocurrency during the entire trade.

- The buyer will usually pay the agreed-upon price for the cryptocurrency to the escrow agent upfront.

- Once the trade is complete, and both parties are satisfied, the escrow agent will release the cryptocurrency to the buyer.

- If either party backs out of the deal or tries to scam the other party, they will forfeit their payment and will not receive any cryptocurrency.

That’s it.

2. It Is Very Secure

You’ve probably realized that while reading the previous paragraph, but crypto escrow transactions are actually quite secure.

Not only does the escrow agent hold onto the currency during the trade, but the buyer usually pays the agreed-upon price upfront. This means that even if one party tries to scam the other, they can’t.

Take P2P transactions on platforms like Binance or escrypto.com. If a seller goes out and finds a buyer, they first send a request. If they agree to the terms and the buyer sends the money, the crypto being sold is held up in an escrow, until the seller receives the funds.

When they confirm that they’ve received the funds, the crypto is only then transferred to the buyer and the transaction is complete.

So, you see, if either of the parties tries to pull a scam, they can’t. Either the buyer gets the money back or the seller gets their crypto back and both live to see another day.

3. It Gives You Peace Of Mind

When you’re trading cryptocurrency, there’s always a bit of risk involved. You never know if the other party is going to try to scam you, or if they’re even going to show up at all.

With an escrow transaction, you can rest assured knowing that the cryptocurrency is being held by a third party during the trade.

4. It’s Quick And Easy

Another great thing about crypto escrow transactions is that they’re quick and easy.

This whole process usually takes less than 30 minutes.

Now, it could last longer, or be over in less than 10 minutes, but that depends on the details of the trade and on the parties involved.

One thing that could slow down or speed up the process significantly is the payment method. If you’re receiving the funds in your bank account, that could take some time. On the other hand, if you’re using Wise – it’ll be over in minutes.

5. It’s Not That Cheap

Whenever there is a third party involved you kind of have to consider there will be some fees.

Now, they might not be astronomical, but they’re still there and you should take them into account.

For example, if you use a particular escrow agent or a platform to buy or sell cryptocurrency, they could charge a 1% fee on each trade. So, if you’re buying $100 worth of Bitcoin, the escrow agent will take $1 as a fee.

Now, one thing to keep in mind is that this is usually a split between two parties, so it’s not like only one of you is losing 1% of the transaction value.

As you can see, this fee is not too bad, but then again, it’s not that small either.

If we’re talking about major transactions, that 1% could be more than substantial.

Are Escrow Transactions Better Than OTC?

This is a tricky question to answer because it’s not actually the transactions that you need to compare and evaluate – it’s your needs.

Essentially, they’re both great in their own ways and they both have their pros and cons, so it really depends on your needs as a trader.

OTC transactions are great because they’re fast, convenient, and usually don’t come with lower fees.

Also, they’re equally safe, as long as you’re trading with a reputable source or a platform.

Escrow transactions are great because they offer an extra layer of security and peace of mind.

However, they might be a bit slower and come with higher fees.

In the end, it all comes down to what you need and what you’re comfortable with.

If you want convenience and speed, go for an OTC transaction. If you prefer dealing with actual humans rather than platforms, escrow is the way to go.

So, it’s really up to you!

Conclusion

Escrow transactions are a great way to protect yourself when trading cryptocurrency because they create a third party that holds onto the currency during the entire trade.

This ensures that neither party can back out of the deal or try to scam each other because they would forfeit their payment.

So, if you’re planning on doing any large trades, be sure to use an escrow service to protect yourself and your investment.