Can a Pending Crypto Transaction Be Reversed?

Cryptocurrency has made some giant waves in the world of the economy as it has changed the way currency and money is treated around the world. Now money has become a volatile asset, and it no longer stays in the form of a stable paper currency. Cryptocurrency uses a decentralised method of management in which there is no central body that checks over the transactions, nor is it verified from a central server base. Sometimes this creates a lot of issues for the users, and some users even make use of such features and exploit other users.

So in this article, we will discuss crypto transactions and understand if you could reverse them along with various crypto attacks by some users. For more information you can visit http://www.solu.co.

How Does A Crypto Transaction Occur?

The paper currency had the advantage that users could give the other person some paper currency. The transaction is considered complete, but in the case of cryptocurrencies, these do not exist in real life. Cryptocurrencies are no tangible assets that can be possessed or carried on somewhere; these cryptocurrencies have their ownerships based on signatures.

There is no going back once the signature is changed and ownership is transferred.

The crypto transaction occurs with the help of private and public keys, which are the wallet address to which the cryptocurrency has to be transferred. The public key is sent to the people to whom you can send cryptocurrency in the future or have made a transaction with them. The private key is a secret key, just like your ATM pin, which has to be entered only at the transaction time, and it has to be kept confidential.

The transaction is done via blockchain, and for a secure transaction, there is a need for an empty block, so the requirement of a miner comes at such an instant. The miners are the people who take up the task of solving massive equations and finding an empty block for storing the transaction information. The miners are paid their fee on the completion of the transaction by the wallet itself, the owners decide the fee as they place the amount they offer for a block, and if the miner finds the amount valid, he accepts the transaction and finds the block for the same.

Can Crypto Transactions Be Reversed?

The crypto transaction does not include sharing a physical asset, so its ownership is decided based on its hash signature. If the seller and buyer have made the confirmation and signature have been placed, you cannot reverse the transaction.

Why Can You Not Reverse A Crypto Transaction?

The crypto network is decentralised, and in such a network, there is no central body that checks for both parties. In such transactions, the transaction is validated when both parties share a confirmation for the transfer. So when a transaction occurs in cryptocurrency, it can be refunded only when the receiver is willing to confirm the same.

Multiple Crypto Attacks

Users face multiple crypto attacks, and some of them are listed and discussed below.

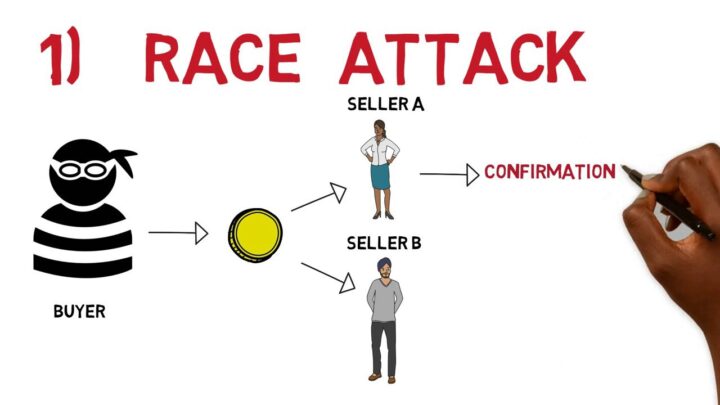

1. Race Attack

In such an attack, the same amount is displayed twice in a transaction with two different buyers, the seller sets a commission on a transaction, and a miner begins working on it. He sets a higher commission on the same transaction. So, among the two users, only one will get the cryptocurrency in their wallet, while the others will go in vain. There is no specific way of eliminating the possibility of this attack, but you can minimise it by using specific outbound connections.

2. Brute Force

This is an expensive attack, and it has a lower probability of success, but if it becomes successful, it’s impossible to impose any changes on it. These types of attacks occur when buyers try to buy a product, and for this, he looks for blockchain’s variation, and when their number of confirmations exceeds a specific number, then the product is shipped. But if the number of confirmations on the buyer end exceeds, he breaks the variation and gets the funds back in his wallet.

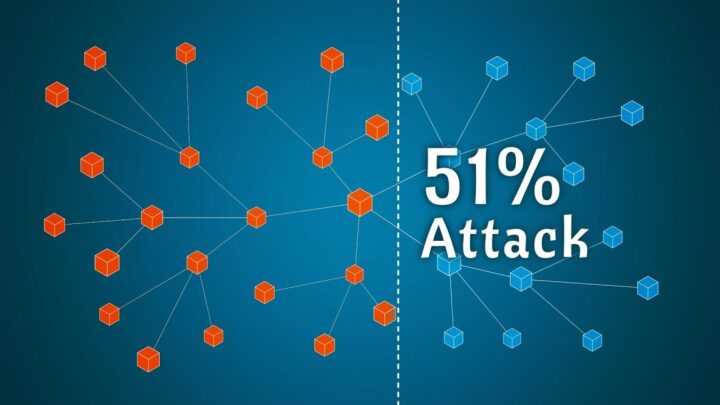

3. 51% Attack

This is a theoretical attack, and various investors and traders have put forward their ideas, but they believe that this attack is impossible in the real-life market. The traders believe that if someone can achieve 51% control of a hash network, he will generate hash blocks with maximum efficiency and speed. If they can generate blocks quickly, it would become much easier to receive a maximum number of conformations, and once it becomes true, a brute attack is possible.

4. Finney Attack

This attack is a bit complex as this can be performed by a miner who already has a block with himself; this attack is a step forward from a race attack, as in this attack. The miner allows the block and gets the commission, and then he sends some coins to his previous block without sharing the transaction in the public system.

These are not very successful attacks. All credit goes to the whitepaper of Satoshi Nakamoto, who put forward various policies along with the invention of bitcoin, which reduced the chances of fraud and attacks in transactions.

Advantages Of Irreversible Transactions

The credit card companies shared fantastic information that they had to face severe losses due to chargeback; the chargeback is the total amount spent on reversing a transaction or an act of fraud. But with the precautionary measures like irreversible transactions in cryptocurrency, these charges are reduced, and chances of fraud have also been reduced to greater extents.

Conclusion

Blockchain is a fantastic idea, and it is revolutionising the market, especially; with this technique, the world has reached the verge of encryption and privacy. Cryptocurrency is just a token for utilising blockchain in the financial market, so it is safer to trade with this technique at your hand and in a decentralised market. But as there are no direct laws against fraudulent acts in crypto trading, if you face a loss, all its weight is going on your shoulders.