The Big Scams to Watch out for in 2024 – & How to Avoid Them

Scams and online fraud are everywhere we look, but if you’re unsure what to watch out for, it’s sometimes all too easy to be tricked into parting with your cash.

Today, we run through some of the most prevalent scams emerging in 2024 and ways to safeguard your money, as highlighted by the consumer finance experts at Wonga.

The short term credit provider also explains some of the simple defences to put in place to avoid becoming the latest victim in the multi-billion pound scam market.

Email and SMS Phishing Scams

Phishing is a common form of data fraud, and most illegal scammers use formats and layouts that look incredibly convincing! Think:

- Emails purporting to be from the tax office stating you have a rebate.

- Messages explaining that you’re owed an insurance payout.

- Banking alerts that claim to be letting you know about an attempted breach.

- Threats of prosecution or fines due to late payments you aren’t aware of.

While the logos and style of these communications might pass an initial inspection, it’s highly unusual for a trusted bank or financial provider to contact you asking for private details (after all, if they’re legitimate, they should have all your data on file!).

More often than not, a phishing scam works by asking you to click on a link and fill in some information.

That could include your banking details, personal identity information, and even a scan of your passport or driving licence.

Criminals use that info to take out fake loans on your behalf, pay for expensive purchases, or try and steal your identity in other ways.

Authorised Push Payment Fraud

Our next fast-growing scam surrounds push payments.

Usually, a hacker has retrieved customer information and knows that their list of intended victims has fairly sizable payments to make.

The fraudster then calls or emails, prompting you to make the payment – but the account doesn’t belong to the intended recipient.

These crimes are most common in areas such as stamp duty payments in the UK, whereby a hacker knows that their list of targets have funds ready and are anticipating a large remittance.

Ultimately, you’re willingly transferring sums of money on the instructions in an email or phone call to the wrong person.

APP fraud has skyrocketed in 2024, costing consumers over £207 million in the space of six months, and is expected to remain one of the biggest threats to consumer safety in the year ahead.

Advance Fee Consumer Scams

Advance fees encourage new customers to pay upfront for a service, usually something with incredibly good value, or even a free provision with a small subscription cost.

Examples include:

- ‘Free’ support to claim an inheritance you’ve never heard of before.

- Paying to register with a modelling agency that’s scouted you from social media.

- Applying for a massively competitive loan, which requires an application fee.

- Being asked to pay a nominal processing charge to access a prize you’ve won.

These scams have one thing in common – the criminal has zero intention of providing any service once they’ve received your card payment or bank transfer safely into their account.

How to Protect Yourself From Online Fraud in 2024

Now we’ve looked at these criminal enterprises and how they convince everyday people to send them money; let’s talk about preventatives.

Most scams depend on sophisticated communications that replicate the correspondence you’d usually receive from your regular bank.

Scratch away the surface, and the truth quickly becomes apparent.

Verify Email Addresses and Link Pathways

First, if you receive anything via email, you should hover over the email address to see who the sender really is.

Sometimes, this isn’t obvious, as a scammer may try to get as close to the genuine website as possible.

Say you bank with hsbc.com, you might receive an email from hsbc.co.com; similar, but different, and definitely not the same person.

In any case, it’s a good habit never to click on a link in an email. If you deal with the business, go directly to the website, and access your account from there.

If that’s not possible, take five minutes to give them a call before you click on a link that might intend to drain your savings.

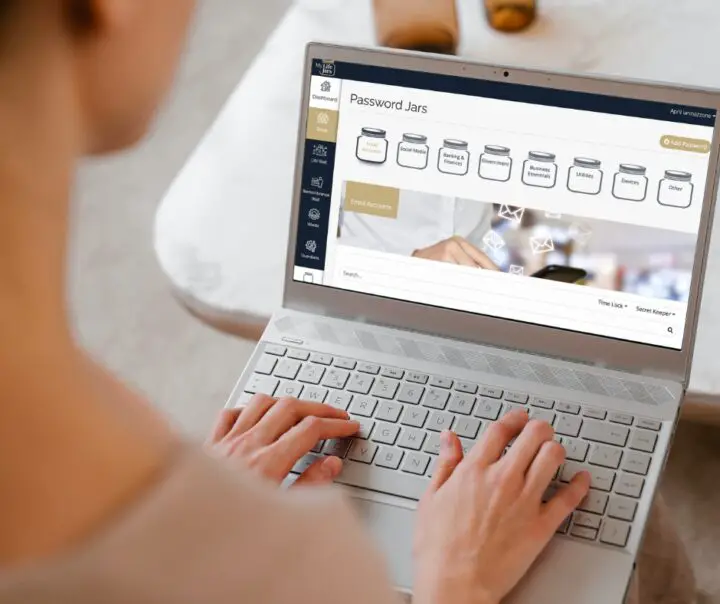

Keep Your Passwords Stored Safely

We all have countless online accounts, and if you’re smart about safety, you’ll probably have a few dozen passwords.

Remembering passwords can be difficult, but it’s highly advisable to reset passwords and vary the login details you use since one hacked account could compromise everything you do online.

Free password storage software is a great option (and widely offered by cybersecurity providers such as Kaspersky), accessed by a security key or fingerprint on a mobile device to look up your login – without putting yourself at risk.

Protect Your Personal Details

As we’ve mentioned, any organisation you deal with should have most of your information on file, so it’s improbable they’d ask you to submit your address, date of birth, maiden name and shoe size via email.

Correspondence asking for anything private is best regarded with suspicion, especially if you’re asked to supply a PIN or password.

Never Feel Pushed Into Financial Transactions

Nearly every online scam is based on urgency.

If you need to click on a link immediately to receive a large payment or avoid being prosecuted for a bill you had no idea you owed, it’s probably suspicious.

Scammers love to inject a sense of frantic action, which means you rush to solve the problem without stopping to inspect the source of the request or question why a company you’ve never dealt with is chasing you for money.

Check Your Credit Reports Regularly

Finally, it’s worth mentioning those quieter scams that aren’t always apparent.

Things like online sites that take a one-time payment but then repeat that small deduction every month without anyone noticing.

This tactic is common in services such as online templates for CVs or letters – your £5 download charge keeps coming out every month, increasing gradually over time before you realise.

Keeping an eye on your credit reports and checking your bank statements might be tedious.

Still, it’s an excellent way to spot if there are any transactions, credit agreements or payments that you don’t recognise.

Remember – everyone, everywhere, is a potential target, so try not to get complacent, and take a minute to verify the authenticity of anything you’re tempted to click on.