Tax Refund Advances and Loans – Smart Choices

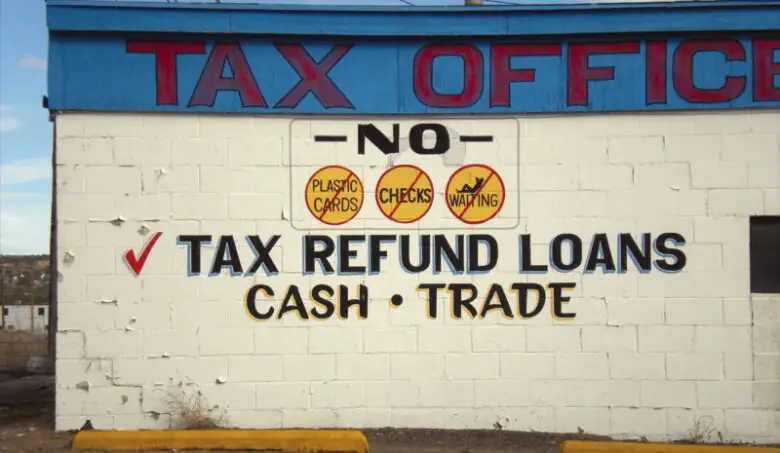

When it comes to taxes, most of us do get confused by how National Revenue Services work. Tax refunds are more confusing because they are actually like getting some commission just for filing your tax return on time. Now, a good number of people do hate waiting for tax returns even if the period in which tax returns are processed in only 21 days. It is because of our mind that some of us opt for a loan that will eventually be offset using the tax refund amount by the end of the 21-day window.

Understandably, people have different needs as well as emergencies. However, it is advisable not to go for a loan that is guaranteed by the tax refund. What is the reason behind that? There are two reasons, and these reasons are risks. These risks are as follows. Firstly, taking a loan against your tax refund might lead you to pay more in terms of interest and processing fees. Secondly, you may jeopardize your creditworthiness at an instance. It is essential to be a bit persevering instead of making your life miserable with these loans on tax refunds.

What are the disadvantages associated with taking a loan against your tax refund?

As much as taking a quick loan and making your tax refund as a guarantee; loans on tax refunds is a risky undertaking. Here are several risks you could ditch yourself into whenever you decide to take a credit on your tax refund.

Loans become a burden if IRS miscalculates your tax refund

Social and digital computer systems are prone to errors. Given that computers do take in the garbage and eventually give garbage, errors in tax refund calculation do occur. In some rare cases, the taxman may miscalculate the amount of tax to be refunded. Now, when the amount indicated is more than the required, then we might get tempted to borrow a loan, which is almost equal to or equal to the tax refund. However, things will go wrong if the tax man rectifies your tax calculation error. If that happens, you will have to carry the burden of paying for the new loan that may not have been offset by the tax refund. There will be a burden of the additional loan amount plus the interest on investment as well.

You end up paying unnecessary fees

Nothing comes for free. If you decide to greedily and hastily go for loans and use your tax refund as a guarantee, then you will surely immerse yourself into extra charges. Most commercial lending institutions are known to offer loans on a tax refund to benefit from service charges, interests as well as other unnecessary charges. In that case, whenever you decide to take a credit on your tax refund, you are merely inviting such extra payments. Some of such payments are hidden and may never be disclosed when you are applying for this loan.

How can you avoid risks and burdens associated with Refund Loans and Advances?

Use e-file and wait for direct deposits

Considering that your tax refund will be completed in just 21 days, why pay more if you can expect. As soon as you file your tax returns using e-file, there are about 99% chances that your money will be in your account within the set period. Now, if you will be a bit patient and persevering, then you will get your direct deposit. When that happens, then you will not need to pay more in terms of charges and interest on refund loans and advances.

Consider credit unions and local banks for credit

Sometimes, life, for some people, might seem impossible without loans. Borrowing is not a crime. It is entirely acceptable, but you need to borrow from the right place. The best lenders include local banks and credit unions. Why is that so? It is because they lend money to low interest. If you borrow from these institutions, you will realize that it is low-risk borrowing.

On the other hand, loans and advances against your tax refund could prove costly. In the end, you will be diving into very risky borrowing. Avoid borrowing loans or advance and using your tax refund as collateral. Just get yourself to borrow from local banks and very low-interest credit unions.

Avoid refunds and if not possible, minimize the at all cost

Did you know that you can do away with a tax refund? If not, ultimately, you can decrease the amount of return that the revenue authority will be sent to you as a refund. To avoid a tax refund, all you need to do is file the precise amount. The amount of your file should not be excess to the extent that you will be one of those being refunded. Sometimes, taxpayers do consider filing more and paying more in terms of taxes to accrue hefty tax refunds. The more the tax refund amount, the more the temptation to take a huge loan or advance. To avoid that, do pay exactly in terms of taxes, and that will help you avoid tax refunds. For more, you can check pureloan.com.

Food for thought!

Life is all about coming up with a budget that helps you live within your means. You need to avoid advance and loan one tax returns by only starting with your budget. A reasonable budget is that which helps you get value for your money. Whatever little you earn needs to be utilized well to avoid the urge to borrow more. Borrowing without taking a keen interest in the underlying risk is like going into a vicious cycle of debt and unnecessary cost. Loans on tax returns are always risky costly and full of the tag line—those essential hints about a tax refund, loans, and advances.

Read more at Planet-loans.com.