8 Tips for Budgeting Like a Pro

Regardless of how prudently you spend your money, you can stress yourself out if you don’t have a budget plan. Knowing how your cash flows in and out of your bank account at any time makes it much easier to relax. Still, it can be intimidating to review your finances and figure out how to keep that cash flow moving. Check out these eight tips to help you create a reliable budget that will help keep you on track.

1. Spend Only What You Have

The first step toward building a budget is to consider your bank account, and associated debit card, your only spending tool as stated by Chime. If you don’t have a credit card, this is already true — but if you do, this mindset lessens irresponsible spending. That’s not to say you shouldn’t have a credit card; however, only use it in tandem with your account balance. When planning to make a purchase, make sure you can afford it, whether you use your credit or debit card.

If you do use a credit card to make a purchase, set aside money to promptly pay it back later. Assigning these funds right away prevents you from missing payments and building up your credit card debt.

2. Use a Budgeting Program

There are a variety of programs on the web that produce intricate budgeting tips, templates, and organization. A dedicated budgeting platform is perfect if you understand finance basics but find it overwhelming to begin planning on your own. These platforms are designed to provide a thorough snapshot of your money and present otherwise difficult-to-determine data. If you’re looking for in-depth budget analysis and planning, you’ll find it here without delay.

Oftentimes, you can use these programs according to your needs — you only have to utilize what works for you. A downside to them, benefits notwithstanding, is that many of them are not free and can be quite costly up front.

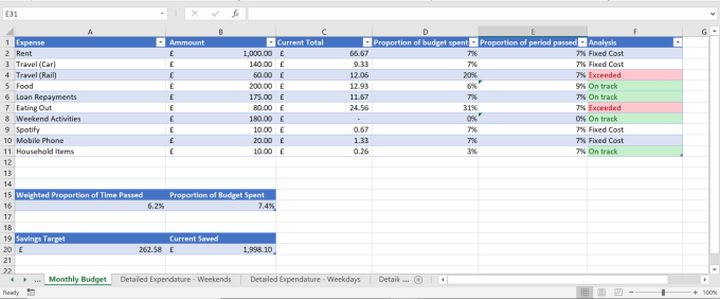

3. Maintain a Personalized Spreadsheet

The problem that pushes many people away from programs is the price as well as how complicated they can be. Some people aren’t as familiar with financial planning as those for whom a program might be tailored, and that’s okay! You can get started at your own pace with a simple and convenient personalized spreadsheet. Just take some time to note your income, expenses, bills, and spending habits, and you’ll already be improving your financial situation.

The best part of a personalized spreadsheet is that it can be as simple or complicated as you want. If you benefit from a straightforward bird’s-eye view, then that’s all you need to create.

4. Plan Based on Your History, but Adjust as You Go

Now that you have a comfortable platform for your spending plan, you can take a look at your financial history. Use the past couple of months as a guideline for your situation, but be flexible in case your needs change. How much freedom do you want with your leftover funds compared to how much you’ve recently had? How much do you normally spend per month in a particular category?

Remember, of course, that these numbers will always fluctuate with the unpredictability of life. Situations can change minimally or fundamentally, so it’s beneficial to adjust future plans consistently even if they don’t match the past.

5. Keep Your Plan Conscious and Accessible

We’ve surely all fallen into the trap of making organizational life changes and subsequently forgetting them — it’s only human. Take a moment to consider how you might be able to keep yourself conscious of your spending plan. You could set your spreadsheet as your device background, display it on a whiteboard, or activate bank account threshold notifications.

The main goal is accessibility — you want to be able to see your plan with one button click. It doesn’t have to be visible at all times (which might stress you out!), just easy to access. Think of what device you use most, and make your plan show upfront and center.

6. Prioritize Your Expenses

It can be a big help to record all of your important monthly expenses, sort, and pay them based on priority. Start by asking yourself which ones you cannot immediately live without (expenses like groceries, rent/mortgage, and utilities). Then think about those that will affect your financials at large such as credit and debt payments. Once these are taken care of, you can focus on those that are essential for modern living: internet, transportation, clothing, etc.

With these priorities defined, you can set up your monthly payment plan to ensure these are taken care of from the top down. Paying for these necessities first will remove budgeting stress because you aren’t spending that money elsewhere.

7. Diligently Maintain Your Savings

Your savings account should be your baby — the goal is for it to grow consistently over time. It might seem worth it to take a little out to cover an inessential purchase, but it’s best not to. For those who have trouble growing their savings, consider socking away some money into savings as soon as you get paid. For instance, if you save some of each paycheck immediately, you can adjust to living on the rest each month.

This, in turn, will free those funds for the future so you can set savings goals and reliably fulfill them. Once hit, these goals can become lower thresholds— if you want to transfer out, the account shouldn’t dip below them.

8. Make Space for Yourself

At the end of the month, you might not have much money to spare for yourself. There is no need to push yourself to spend if you aren’t comfortable doing so. Still, there is an argument to be made about the importance of making space for yourself in your budget. Being less happy doesn’t affect credit scores, but good scores also mean less if you aren’t respecting your mental health.

Try to create a piece of your budget set aside solely for free impulse spending and self-care purchases. Remember that you are your most important investment, and future you will be thankful for your effort.

Now that you’ve gone through each of these tips, you can already be satisfied with the work you’ve put in. Budgeting, and even summoning the courage to do so, is a big step toward financial freedom. Soon, you’ll be planning out your spending like a pro and finding money in places you wouldn’t expect.