Is Cryptocurrency an Asset or Liability?

The status of cryptocurrencies in the world is not yet completely clear, but there are many assumptions about how they would be treated if one day they are regulated. In the US tax system, they are taxed as personal property. That’s one aspect of how they can be regulated in the financial system.

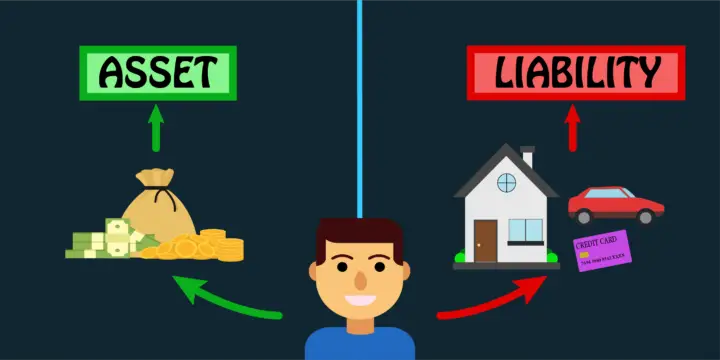

But are they assets or liability? We will first explain these two terms so that we can draw the appropriate conclusion based on them.

What is an asset?

According to economics and financial sciences, assets are resources that are owned by a business, company, organization, or another economic unit. With their help, a positive economic value is achieved. Their value depends on who owns them and can be converted to cash at any time.

They can be tangible or intangible. The first category includes inventory, goods, equipment, while the second includes non-physical resources, such as copyrights, patents, trademarks, software, and even stocks.

What is liability?

In accounting and economics, these are obligatory sacrifices of part of the economic benefit owed by one financial unit to another due to past events. In a way, it is an agreement for the transfer of money or assets, for economic benefits in the future.

For example, these are loans from a person or a bank, which you invest in the development of your own business or something else profitable. Once you have made enough profit, you are obliged to return that loan to the one who gave it to you. An exception may be in the case of a non-repayable loan, which is regulated by an agreement between the two parties concerned.

Can you come to a conclusion yourself, knowing the explanations of these terms?

If you check this go url, you will be able to enter this global market, trade, be part of all the news and activities that will bring you profit. However, some knowledge is required so that you can apply it properly, without putting yourself at financial risk.

The explanation for cryptocurrencies is much more complicated than it seems

If you try to search and find out based on that, you will find different assumptions about what cryptocurrencies are.

According to some, they are a great example of an asset, because it is something that has value, which can be used at a given moment to make a profit. People who have cryptocurrencies, save them and keep them for the moments when they will have good value.

Then they can sell them, exchange them for cash, and even pay for certain products and services.

Furthermore, if we go into details, they are intangible assets, due to the fact that they are not physically available, i.e. they are a digital version of something that does not even exist.

Can they be a liability? Under certain and very specific conditions, it is possible for that to happen. Cryptocurrencies are generally not used as an official means of payment and you cannot get them as a bank loan. But, in agreement with a trader or a friend, you can get a certain loan, which you would repay when you make a profit.

However, in our opinion, the concept of cryptocurrencies is more in line with the definition of intangible assets.

As you can see, what we know about cryptocurrencies can easily be defined in terms of assets. But at the same time, they, along with the blockchain, change so often and it will not be a surprise that one day they will be in a completely third category of property and financial resources.

What else can cryptocurrencies be?

They are designed to function like fiat money. With them, you can buy, pay, invest, profit, and save. They are in some ways an investment, but they are not regulated everywhere in the world.

For example, there are countries where mining, trading, and even setting up any crypto asset is equivalent to a crime. Some countries have addressed this with restrictions on such services. So, somewhere they are a crime.

Furthermore, they aren’t cash or cash equivalents too. Somewhere they are treated as foreign currencies so that transactions can take place smoothly.

Although they have inventory-like properties, they can only be equivalent in certain situations. For example, if you use them only for direct exchange or for payment, without profit, they are inventory.

It can be said with certainty that they are a powerful financial instrument that changes the world with each passing day of their existence.

What is the future of this market?

Although cryptocurrencies have been on the market for more than 10 years, no one can predict what will happen next. We ourselves know that there were days when their values were really high, but also periods when it seemed that the whole crypto world was on the verge of collapse.

The beginning of the pandemic can be taken as a good example. At that time even Bitcoin had a huge drop and it was very unclear what would happen in the future. Recovery was a slow process, followed by dizzying growth. The value of cryptocurrencies often depends on the interest that people have in them.

Due to all these factors, predicting the future is almost impossible.

This market is vulnerable, risky, and unpredictable. The value changes every day. It can easily happen that a collapse and all cryptocurrencies disappear, and we just remember the concept that changed the world at least for a moment.

Conclusion

Finally, we can conclude that between asset and liability, cryptocurrencies are the first. The reasons why this is so are already explained above in this article. Also, more specifically, they are intangible assets, due to the fact that they do not exist in physical form.

However, this classification is not final and can easily be changed if the crypto market continues to grow at a similar pace as it does now.

The only thing we can hope for is that they will be able to be regulated around the world so that all people can enjoy the benefits that cryptocurrencies offer.